december child tax credit 2021

Previously only children 16 and younger qualified. In absence of a January payment though the monthly child poverty rate could potentially increase from 121 percent to at least 171 percent in early 2022the highest monthly child poverty rate since December 2020.

2021 Child Tax Credit And Shared Custody What Parents Need To Know Cnet

To be a qualifying child for the 2021 tax year your dependent generally must.

. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Try it for Free Now. Thats because the expanded CTC divided the benefit between monthly checks issued starting in July and ending in December with the other half to be claimed on tax returns.

Free 2-Day Shipping wAmazon Prime. The advance Child Tax Credit payments began going out to tens of millions of eligible households in mid-July and are being paid in up to six monthly installments through the end of 2021 the last. E-File Directly to the IRS.

The maximum Child Tax Credit increased to 3600 for children under the age of 6 and to 3000 per child for children between ages 6 and 17. This means that a family receiving a 3000 tax credit for one child may receive periodic monthly payments of 250. Many eligible taxpayers received monthly advance payments of half of their estimated 2021 Child Tax Credit amounts during 2021 from July through December.

You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States. For MAGI and Non-MAGI Medi-Cal CTCs are not counted as income in the eligibility determination. Benefit payment dates - Canadaca Benefit payment dates Canada child benefit CCB Includes related provincial and territorial programs All payment dates January 20 2022 February 18 2022 March 18 2022 April 20 2022 May 20 2022 June 20 2022 July 20 2022 August 19 2022 September 20 2022 October 20 2022 November 18 2022 December 13 2022.

Under the enhanced CTC. Most parents have automatically received up to 300 for each child up to age 6 and 250 for each one ages 6 through 17 on a monthly basis which accounts for half of the enhanced credit. The maximum child tax credit amount will decrease in 2022.

Furthermore for Non-MAGI Medi-Cal CTCs are exempt as property for 12 months from receipt of the benefit. Be under age 18 at the end of the year. The sixth and final advance child tax credit payment of 2021 goes out Dec.

The American Rescue Plan Act of 2021 approved child tax credits of up to 3600 300 monthly for children under the age of 6 and 3000 250 monthly for those between the ages of 6 and 17. Upload Modify or Create Forms. The credits scope has been expanded.

For parents of children up to age five the IRS will pay 3600 per child half as six monthly payments and half as a 2021 tax credit. You can claim the full amount of the 2021 Child Tax Credit if youre eligible even if you dont normally file a tax return. To get money to families sooner the IRS will send families half of their 2021 Child Tax Credit as monthly payments of 300 per child under age 6 and 250 per child between the ages of 6 and 17.

E-File Your Tax Return Online. The Child Tax Credit reached 612 million children in December 2021 an increase of 2 million children over six months since the. Ad Read Customer Reviews Find Best Sellers.

Home of the Free Federal Tax Return. Complete Edit or Print Tax Forms Instantly. The new system is part of the American Rescue Plan which.

Who is Eligible To be eligible for advance payments of the Child Tax Credit you and your spouse if married filing jointly must have. 2021 to December 2021. President Biden has proposed extending the enhanced Child Tax Credit including monthly payments for at least 2022.

December 15 2021 830 AM MoneyWatch Monthly Child Tax Credit checks could stop Monthly Child Tax Credit checks set to end if. Therefore any families expecting to receive the payment of 250 to 300 per child on December 15 could see this be their last monthly Child Tax Credit payment. The Democrat Senators are trying to.

It means those not receiving the payments for the first five months but who chose and qualified for the December payment may get the full first half of. It also provided monthly payments from July of 2021 to December of 2021. Starting July 15 families will start receiving monthly payments as high as 300 per child as part of the new expanded child tax credit.

Use e-Signature Secure Your Files. The American Rescue Plan allowed 17-year-olds to qualify for the Child Tax Credit. To claim the full Child Tax Credit file a 2021 tax return.

December marks the last month that. Ad Access Tax Forms. Ad Complete IRS Tax Forms Online or Print Government Tax Documents.

Ad Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. It is not clear whether or not the enhanced credit will be extended into 2022. The American Rescue Plan increased the Child Tax Credit to 3600 for qualifying children under 6 and 3000 for qualifying children 6-17.

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Parents Are Reporting They Have Not Received Their Child Tax Credit For The Month Here S What May Be Happening

Didn T Get Your Child Tax Credit Here S How To Track It Down Gobankingrates

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

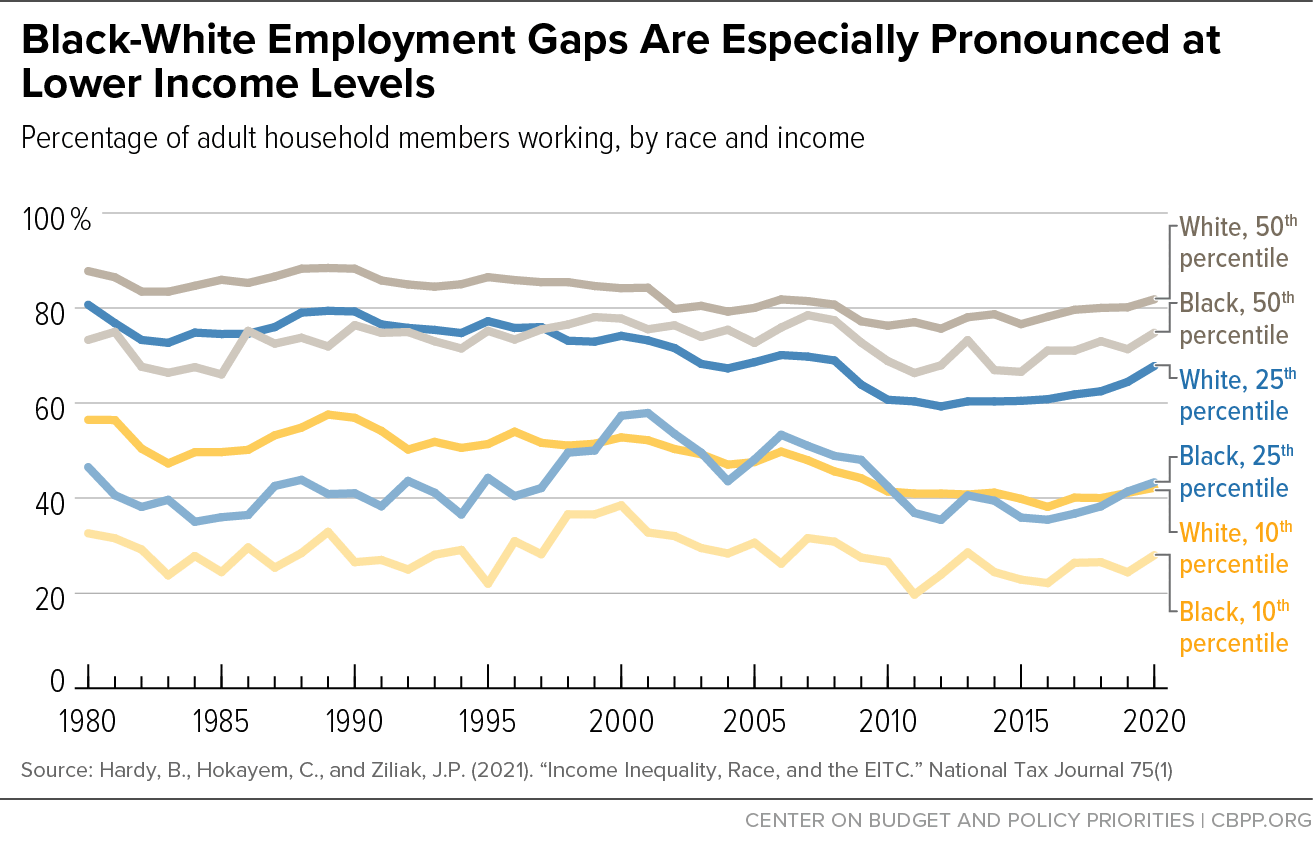

Child Tax Credit Has A Critical Role In Helping Families Maintain Economic Stability Center On Budget And Policy Priorities

3 000 Child Tax Credit Payments Stimulus 2021 California Food Stamps Help

Child Tax Credit Requirements To Obtain A New Direct Payment For Up To 750 Marca

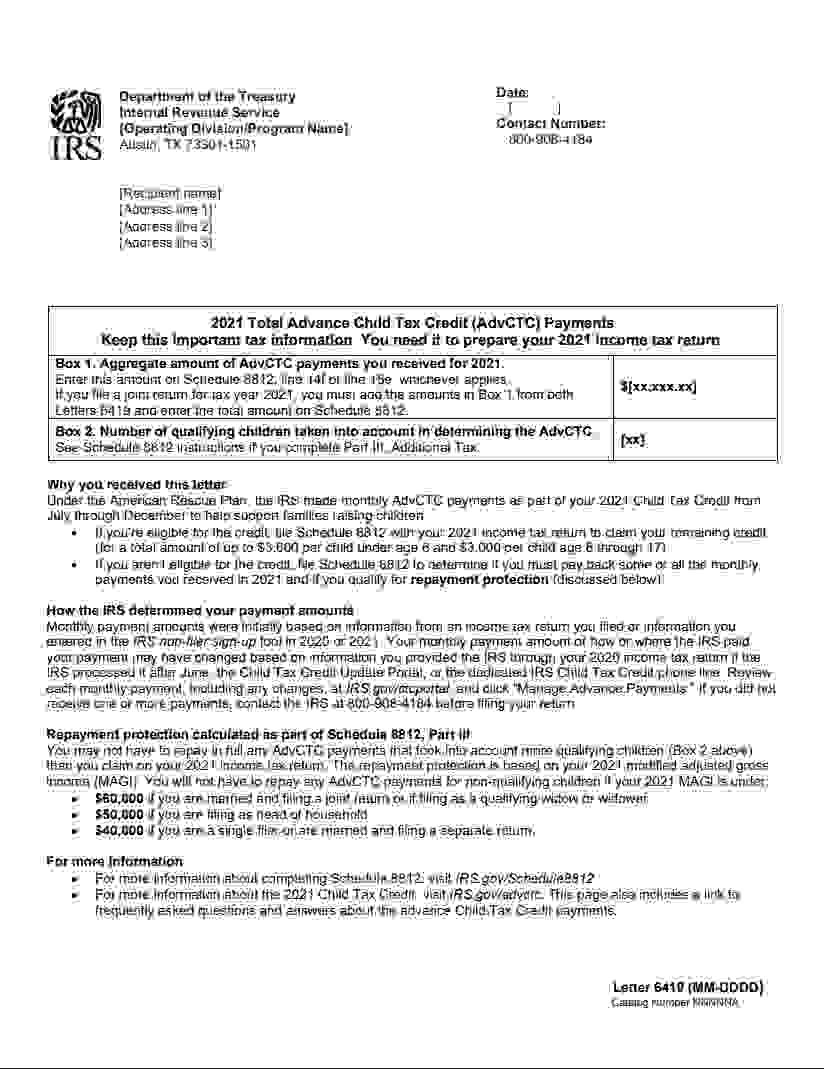

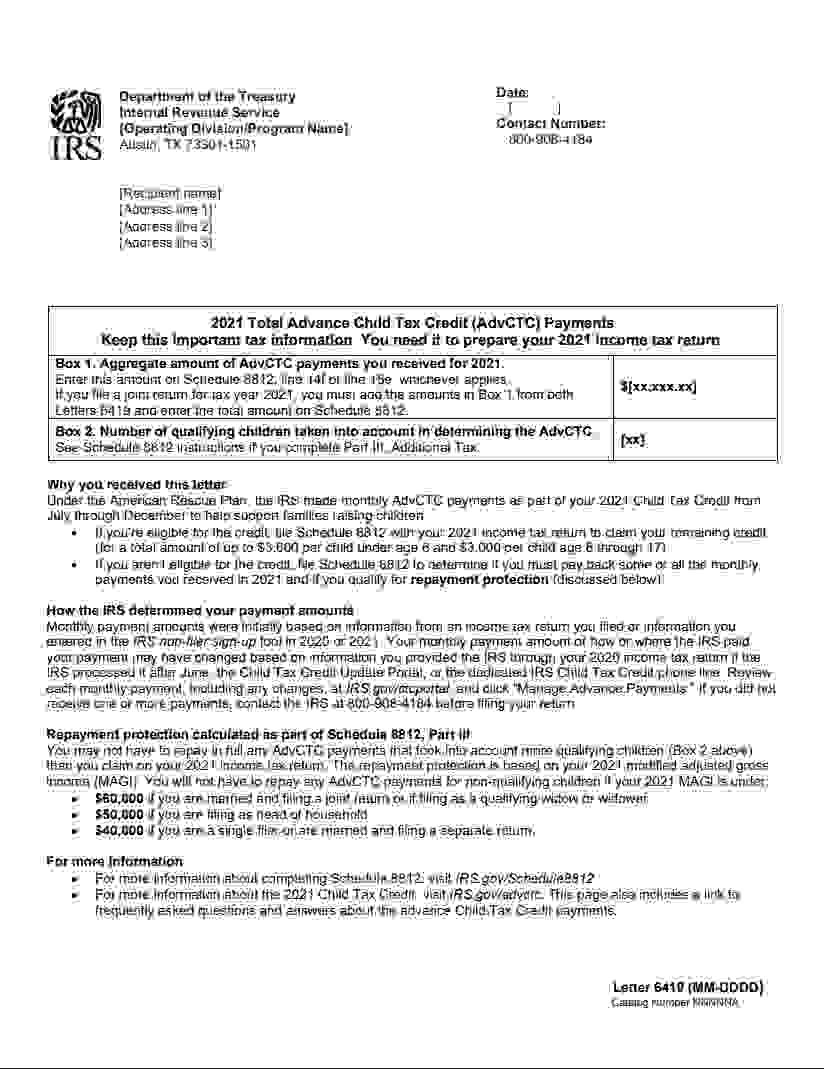

Irs Letters 6419 And 6475 For The Advance Child Tax Credit And Third Stimulus What You Need To Know The Turbotax Blog

The Monthly Child Tax Credit Calculator See How Much You May Qualify For Forbes Advisor

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Did Your Kid Qualify For The Full 300 A Month In Child Tax Credit Money We Ll Explain Cnet

Parents Of 2021 Babies Can Claim Child Tax Credit Payments Here S How Cnet

Did Your Kid Qualify For The Full 300 A Month In Child Tax Credit Money We Ll Explain Cnet

Child Tax Credit Update What Is Irs Letter 6419 Gobankingrates

A State By State Look At How Families Used The Expiring Child Tax Credit

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

Will Monthly Child Tax Credit Payments Be Renewed Forbes Advisor

Child Tax Credit What To Do If You Missed The Deadline Line Financial Blog